One of the key features of the Quant Reports platform is Attribution Analysis, also known as ‘performance attribution’, ‘profit attribution’, or ‘investment performance attribution’. It is a sophisticated tool that can be used give insights into performance of a portfolio or fund manager, and enable better decision making. It begins by identifying the asset classes the managers chooses to invest, and choosing relevant benchmarks for comparison. Generally, the analysis focuses on the investment managers style, and monitoring for style drift. After, the analyst identifies the blend to formulate a customized benchmark of returns, this is used to evaluate the managers performance and identify sources of alpha (for Tactical Asset Allocations) and Tracking Error (for Strategic Asset Allocations).

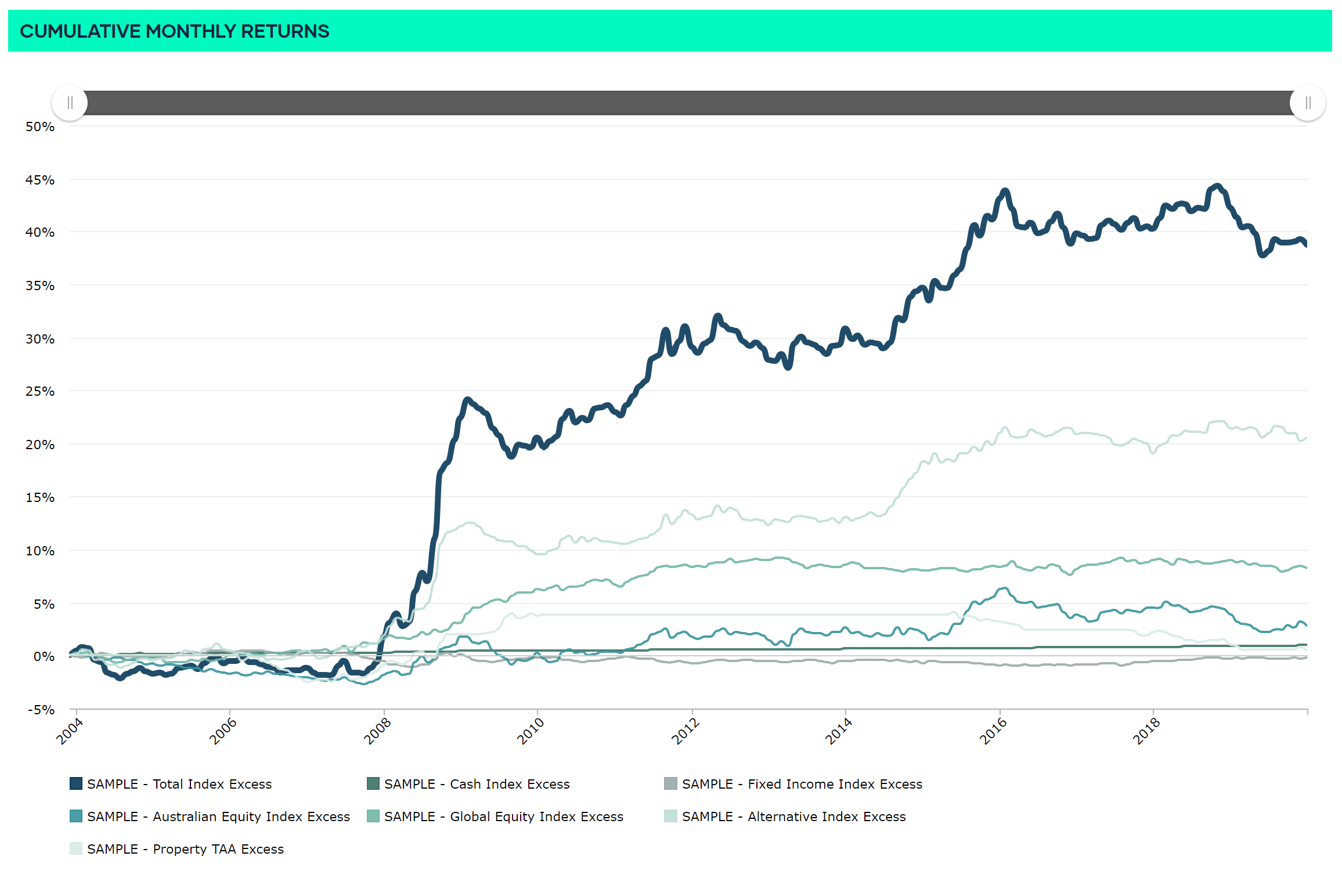

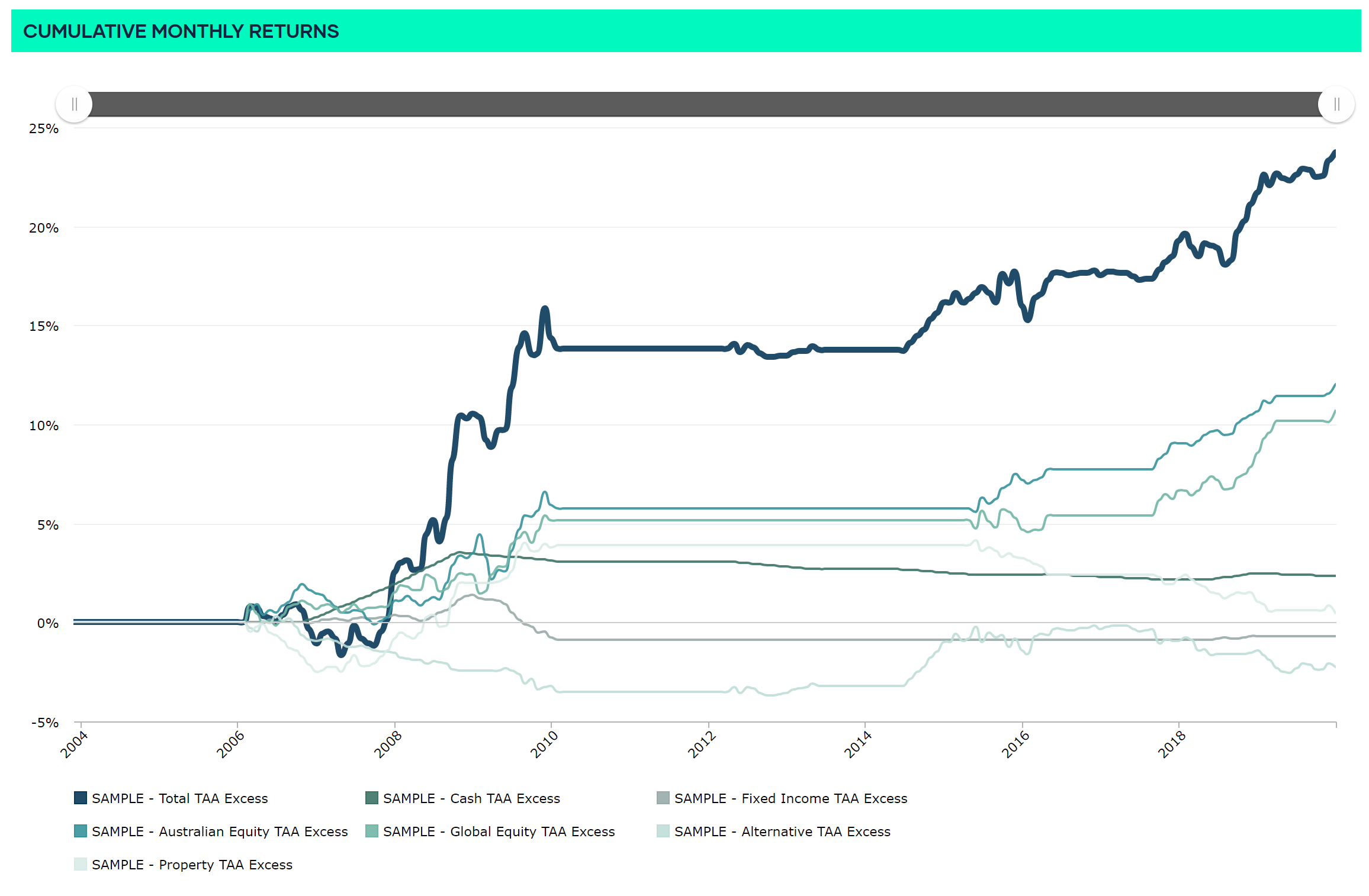

We can see an example from the Quant Reports platform, the screenshots below are taken from the Index Excess and Tactical Allocation Excess. The manager skillfully prevents losses in the 2008 period through Tactical Allocation movements.