Clients are demanding greater transparency into portfolios, therefore the investment professional needs new methods of better explaining fund performance and strategies. Use Quant Reports tools to calculate rates of return, attribution, composite returns, and ex-post risk measures. Having a 30,000 foot view into performance can greatly assist investment professionals making decisions.

Performance measurement

Calculate portfolio performance down to the security level. Follow a wide variety of methodologies across any asset class or currency.

Performance attribution

Our reporting attribution methodologies can enable a Fund of Fund to assess the impact of your investment decisions made by managers.

Composite creation and management

Automate the reporting of composites to stay in compliance with regulatory guidelines. The output can also be repurposed for clients in forms as fund factsheets.

Performance reports

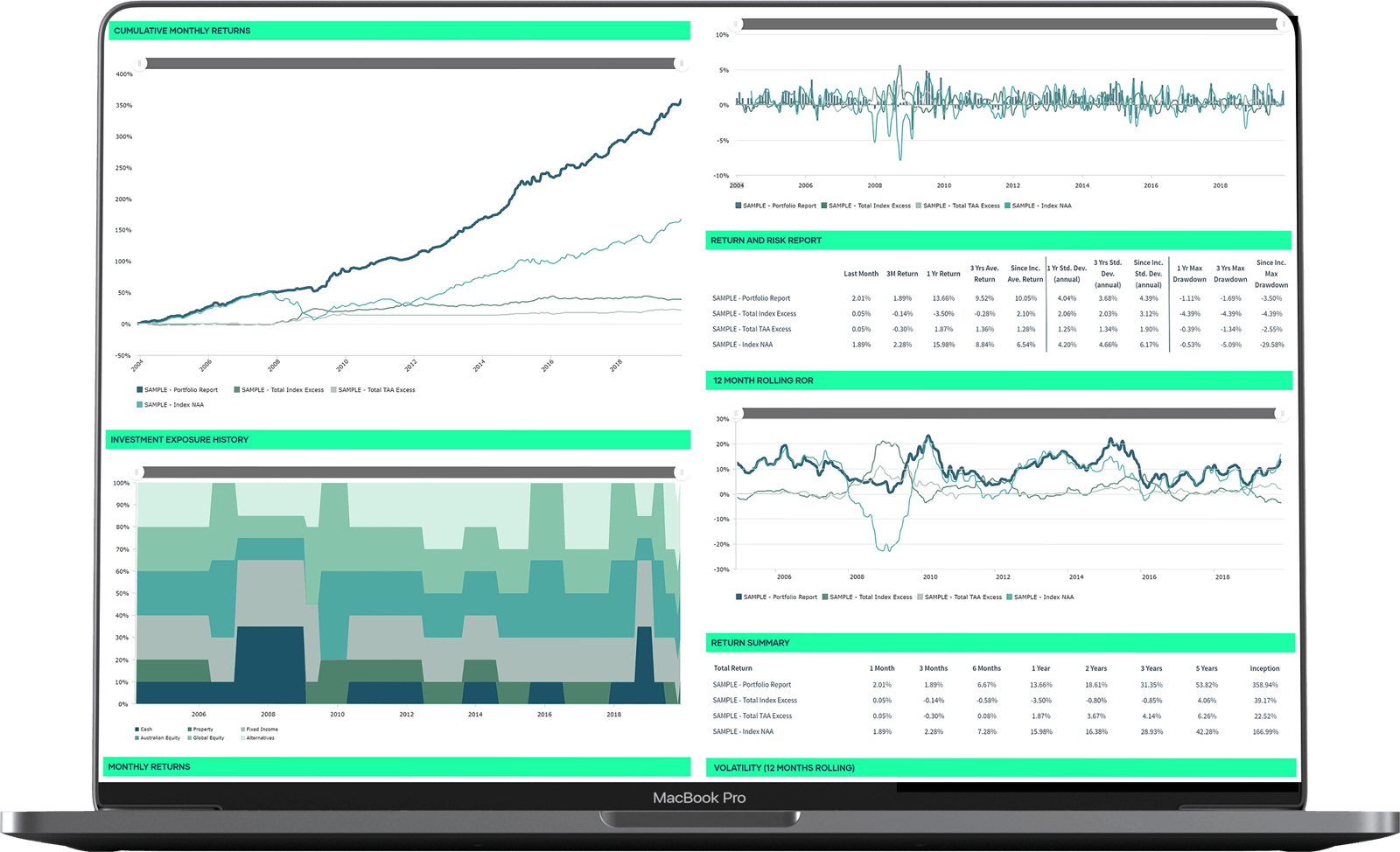

With Quant Reports, with a portal login you can evaluate critical investment insight through intuitive dashboards, fully customizable and white-label automated client reports.

Ex-post risk management:

Using our ex-post risk functionality, you can better understand your or asset class on a broad range of measures, including advanced calculations such as MCtR (Marginal Contribution to Risk).

Evaluate relative and absolute performance.

Using portfolio attribution with Quant Reports, you can understand how management decisions such as sector selection, geographical allocation, and currency tilts affected performance results.

Decision support tool

Analyze the specific exposures that helped or hurt performance by evaluating relative performance using several sophisticated attribution models for equity, fixed income, and multi-asset class portfolios or macro attribution models for fund of fund or asset allocation strategies.

Integrate data across the front and middle office.

Performance, attribution, and risk calculations rely on the quality of data and its aggregation. With the same data and analytics at the heart of each, you can optimize your data integration from performance measurement and client reporting to supporting your compliance and risk workflows.

Find and highlight your unique value.

Analyze your portfolios’ returns against 20,000 equity and fixed income benchmarks. Quant Reports has more than 70 Modern Portfolio Theory risk statistics such as beta, standard deviation, R-squared, alpha, and tracking error.

Compliance.

With regulation complexity on the rise, performance teams can’t afford to rely on manual reconciliation to produce data.