DATA STUDIO

Take full control of your analytics layer

Structure and transform your investment data to deliver cleaner insights, custom attribution, and faster bespoke reporting

BEFORE

AFTER

Static PDFs, scattered metrics

Live dashboards with drill-downs and embeddable views

No dedicated reporting partner

DIY or partner support in a secure, role-based workspace

Version drift, endless re-formatting

Smart templates + pipelines; update once, sync everywhere

Manual prep, hand-typed notes

Automated ingestion, AI-assisted QA and commentary

Siloed systems, messy imports

Custom transforms, full compliance, flexible exports

DATA STUDIO

Shape a reporting engine around your team’s process

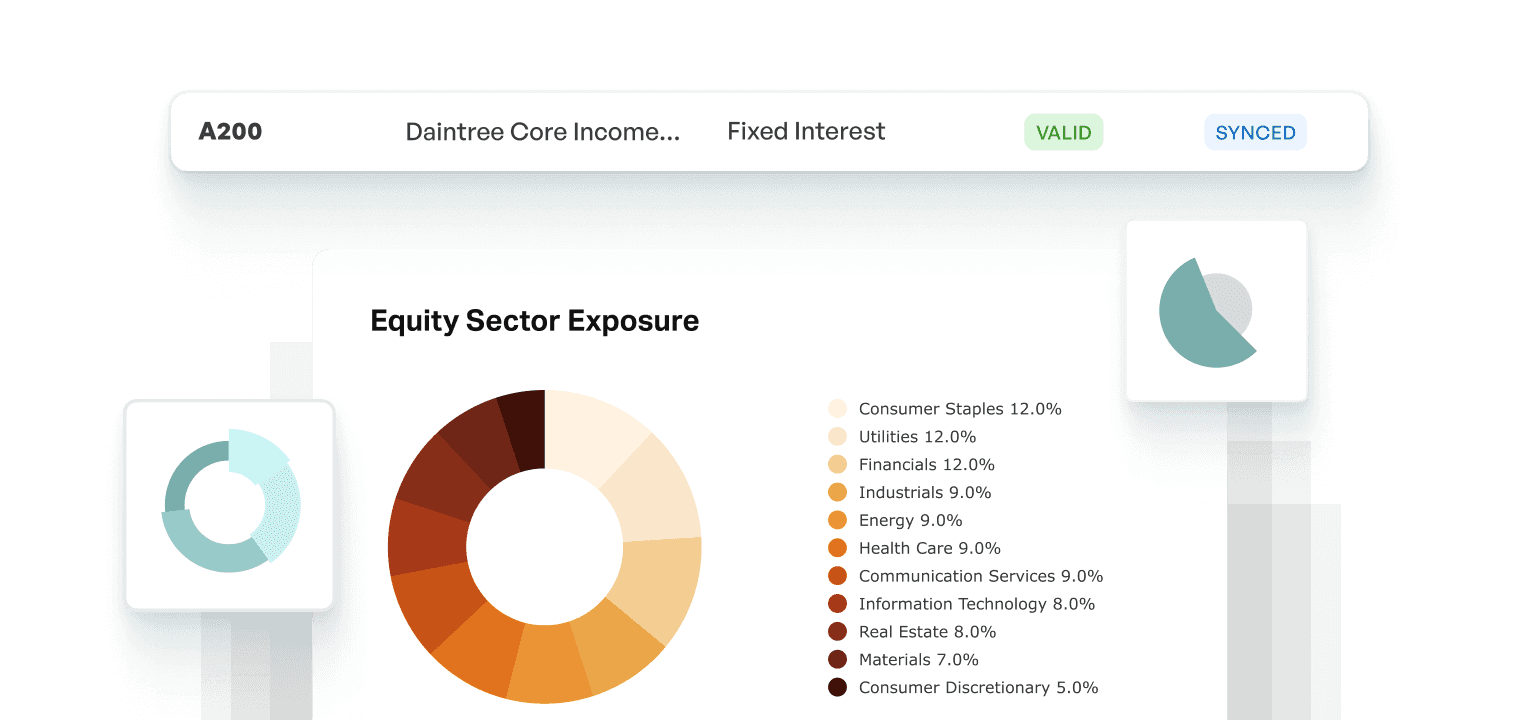

Integrated Analytics

Deliver deeper insights and improve mandate consistency with prebuilt templates and streamlined reporting frameworks.

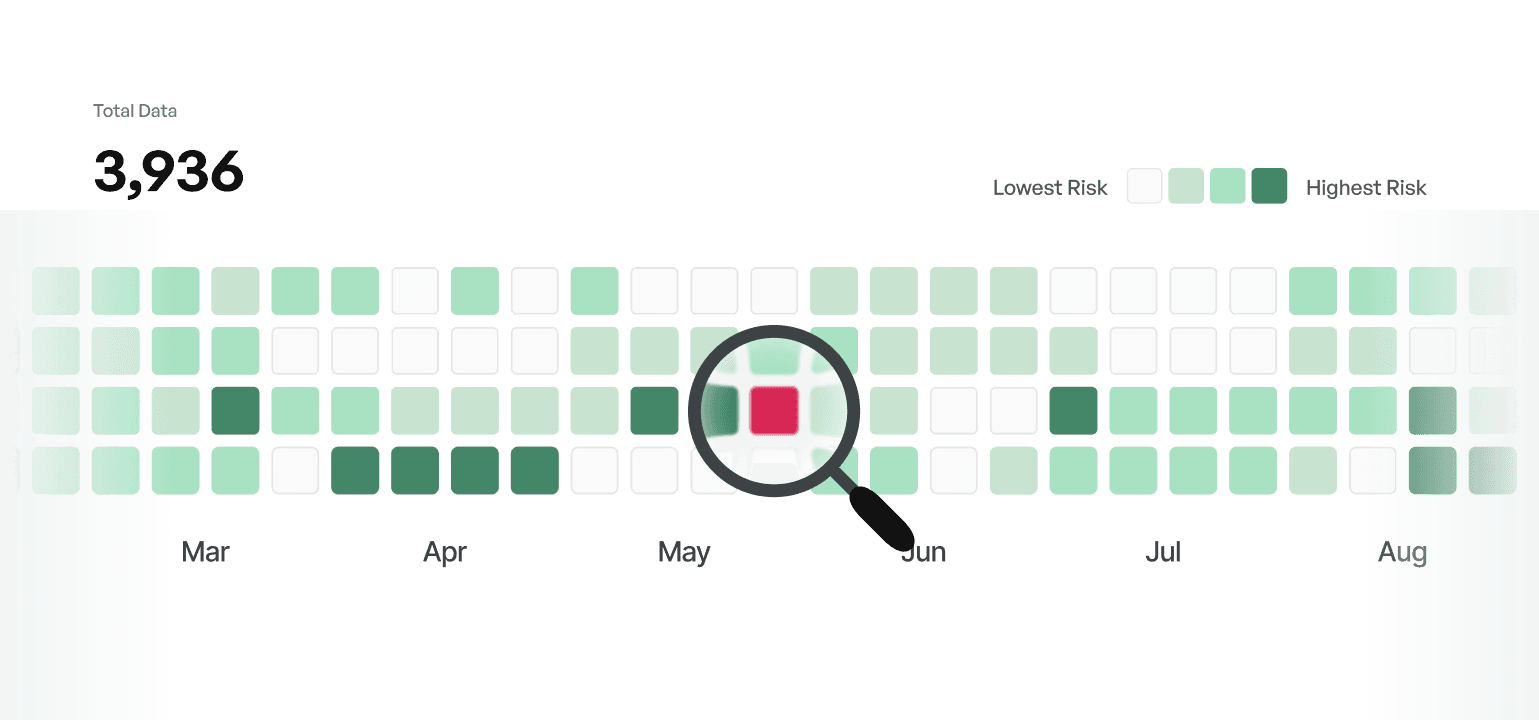

Attribution & Risk

Analyse tactical allocation and risk to uncover hidden alpha and strengthen portfolio resilience.

Committees & Monitoring

Equip decision-makers with clear insights, performance tracking, and objective, data-backed reporting.

Live & Interactive

Dynamic charts, dashboards, and attribution libraries to simplify due diligence, improve engagement, and attract new investors

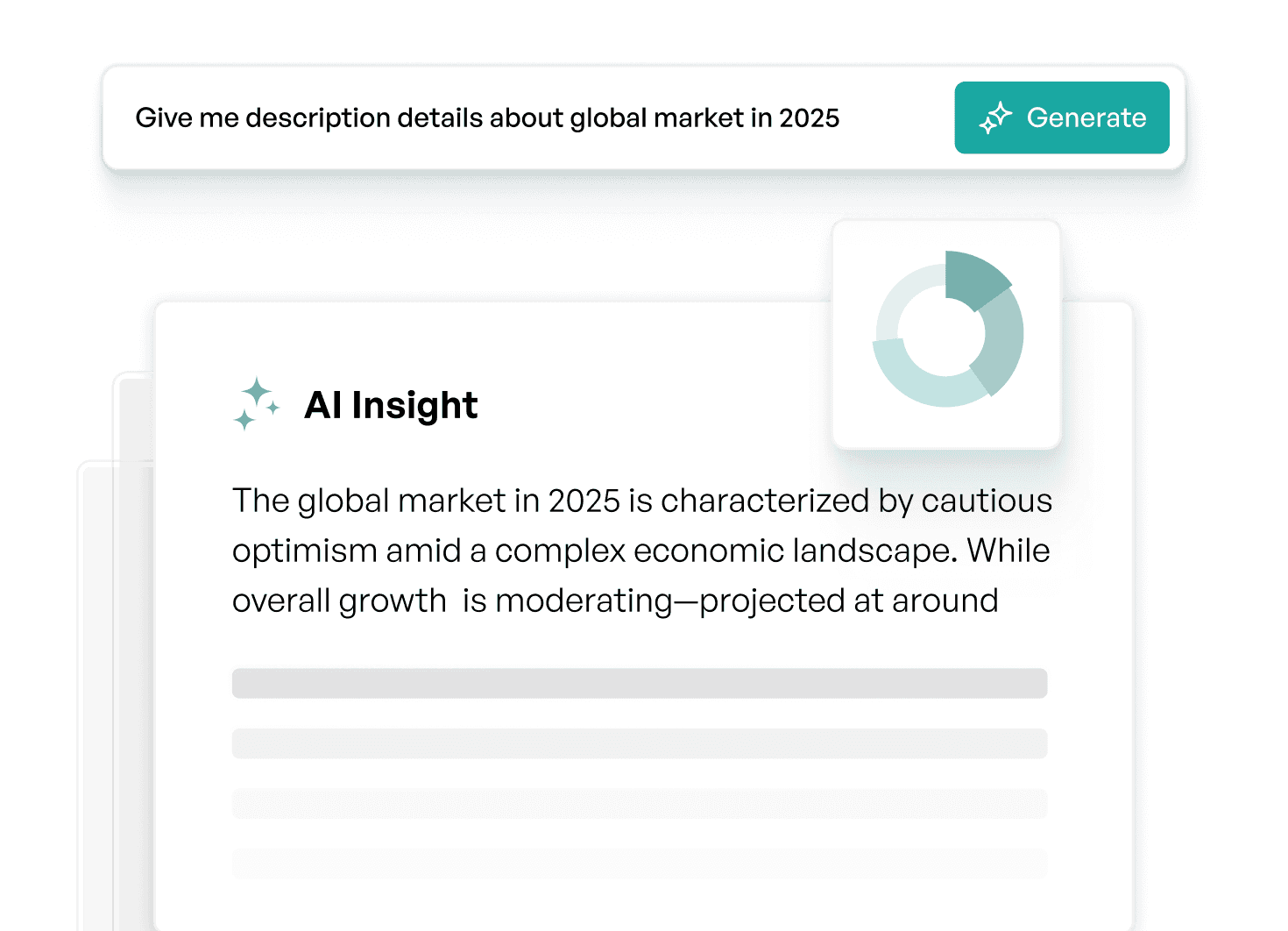

Commentary & AI Agents

Add a detailed narrative and logic that reflects your strategy for a truly bespoke reporting experience.

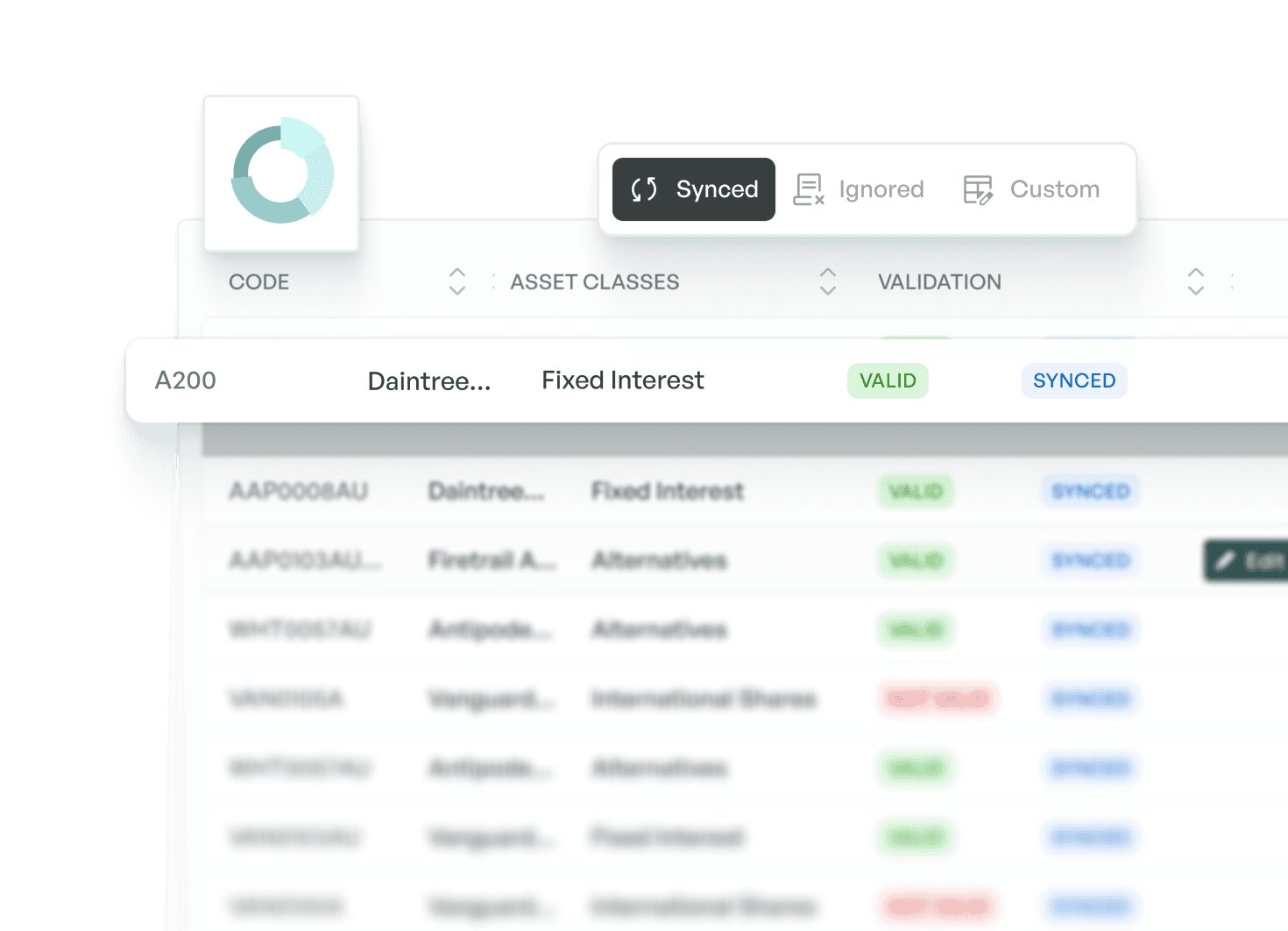

Data Pipelines

Customise your data pipeline to reflect your models, structure, and compliance needs, turning raw data into actionable insights

Shadow Portfolios

X-Ray Holdings

Peer Indexes

Peer Comparisons

Risk Analysis

Relational Data Model

Tactical Attribution

Custom Benchmarks

Investment Monitoring

Factor Analysis

CASE STUDY

Cooper Investors Pty Ltd is a specialist equities fund manager with a track record of more than 20 years.

Cooper Investors—a 20-year-old Australian fund manager of ten specialist equity funds—now uses a reporting framework that automates data ingestion, reporting (Factsheets & Quarterly Reports), and live website metrics, producing on-brand reports seamlessly.